As the 2026 tax season approaches, many Americans are preparing to file their 2025 tax returns and are eager to know when refunds might arrive. For countless households, a tax refund is more than extra income. It often helps pay rent, medical bills, loan payments, or rebuild savings after a year of rising expenses. Although the Internal Revenue Service does not announce exact refund dates for each taxpayer, general processing patterns can provide helpful guidance.

The refund cycle usually begins in late January when electronic filing officially opens. Returns submitted before this period are held until processing starts. Filing early can place a return closer to the front of the line, which may shorten waiting time once the system begins reviewing returns.

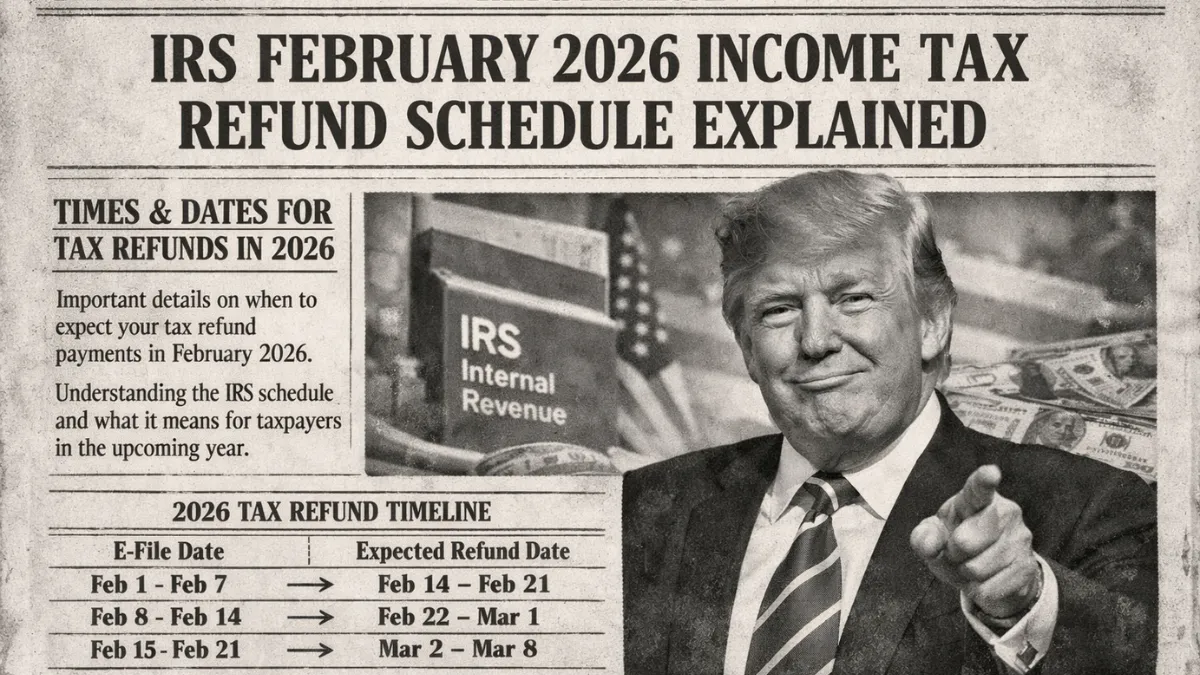

The speed of a refund largely depends on how the return is filed and how the payment is requested. Electronic filing combined with direct deposit remains the fastest method. Many taxpayers who use this option receive refunds within 10 to 21 days after their return is accepted. In contrast, paper returns take longer because they must be handled manually. Requesting a mailed check instead of direct deposit can also extend the timeline.

Some refunds are delayed due to legal requirements meant to prevent fraud. Returns claiming the Earned Income Tax Credit or the refundable portion of the Child Tax Credit are usually held until mid-February, even if filed early. This delay is standard procedure and does not mean there is a problem with the return.

Refund amounts vary from person to person. Income level, tax withheld, credits, deductions, and family status all influence the final payment. Changes during the year, such as switching jobs or adjusting withholding, can increase or reduce the refund amount.

Mistakes are a common cause of delays. Incorrect Social Security numbers, wrong bank account details, missing forms, or mismatched income records may require manual review. Carefully reviewing all information before filing can help prevent these issues.

Taxpayers can track their refund using official IRS online tools, which show whether a return has been received, approved, or sent. Filing electronically, choosing direct deposit, and submitting accurate information remain the best ways to receive a refund more quickly.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines and amounts depend on individual tax situations and official IRS procedures. For personalized guidance, consult official IRS resources or a qualified tax professional.