The 2026 IRS income tax refund schedule comes at a time when refunds play an important role in household finances. For many Americans, a tax refund is not extra spending money. It often helps cover rent, utility bills, debt payments, or everyday expenses that have increased over time. With the filing season officially opening on January 26, taxpayers are paying close attention to when their refunds may arrive.

At first glance, the tax calendar looks familiar. The filing deadline remains April 15, and electronic filing continues to be the most common method. However, the 2026 season includes several updates that may influence processing times. The IRS has introduced system improvements and stronger data verification measures. Returns are now checked more closely against employer wage reports, bank interest statements, and freelance income records. While these changes aim to reduce fraud and improve accuracy, they can also affect how quickly refunds are approved.

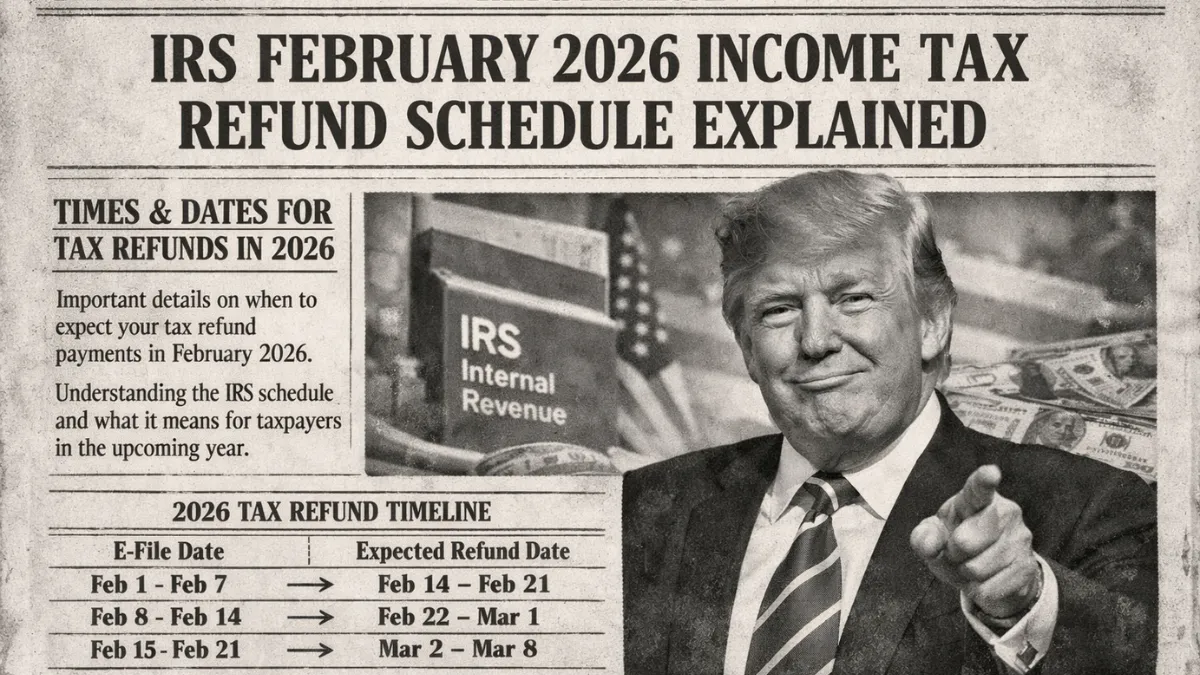

In general, taxpayers who file electronically and choose direct deposit can expect refunds within about 10 to 21 days after their return is accepted. This timeline still serves as a guideline, but it should not be viewed as a guarantee. Simple returns filed in late January may see refunds by mid-February. However, returns that include multiple income sources, freelance earnings, or certain credits may take longer.

Early filing does not always guarantee the fastest refund. If third-party income forms are delayed or mismatched, even early returns can be paused for review. Some tax professionals have observed that returns filed in early February sometimes move faster than those submitted immediately when the season opens.

Refunds involving the Earned Income Tax Credit or the Child Tax Credit are legally required to be held until at least mid-February. As a result, families claiming these credits often receive payments in late February or early March.

Another key change in 2026 is the phase-out of paper refund checks. Refunds are now issued through direct deposit or approved electronic payment methods. This shift is intended to improve security and reduce fraud.

Delays may still occur due to errors such as incorrect banking details or mismatched personal information. Reviewing all details carefully before submitting a return can help prevent processing problems.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timelines and procedures may change based on IRS rules and individual tax situations. Readers should consult official IRS resources or a qualified tax professional for personalized guidance.